The end of financial year is just around the corner, and this is a great time to give your retirement savings a boost and possibly save on tax. There are several strategies you can look at depending on your circumstances and it is always wise to consult your adviser about what is best for you.

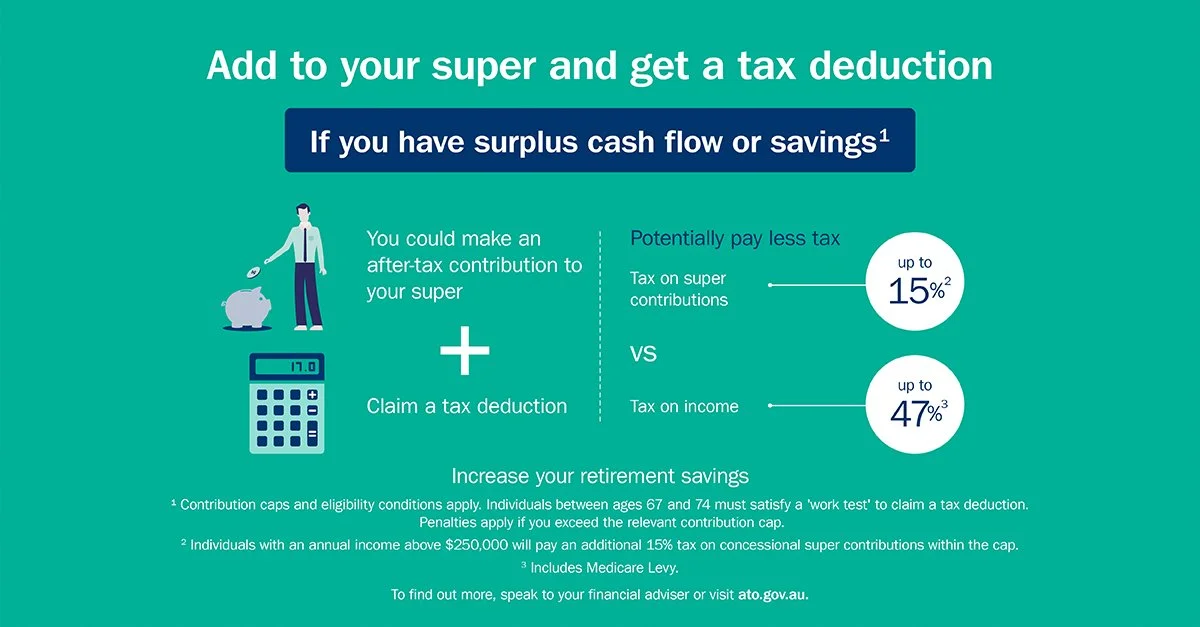

make an after-tax contribution to super

If you an employee, self-employed or earn a taxable income from things such as realised capital gains like a property sale or shares you may wish to consider making an after-tax contribution to your super. Typically, you pay 15% on super contributions which is much lower than the marginal tax rate which may be up to 47%.

Get more from your salary or bonus via salary sacrifice to super

If you are an employee you can arrange for your employer to contribute some of your pre-tax salary or bonus into super as part of a salary sacrifice agreement. This can help to reduce your tax bill.

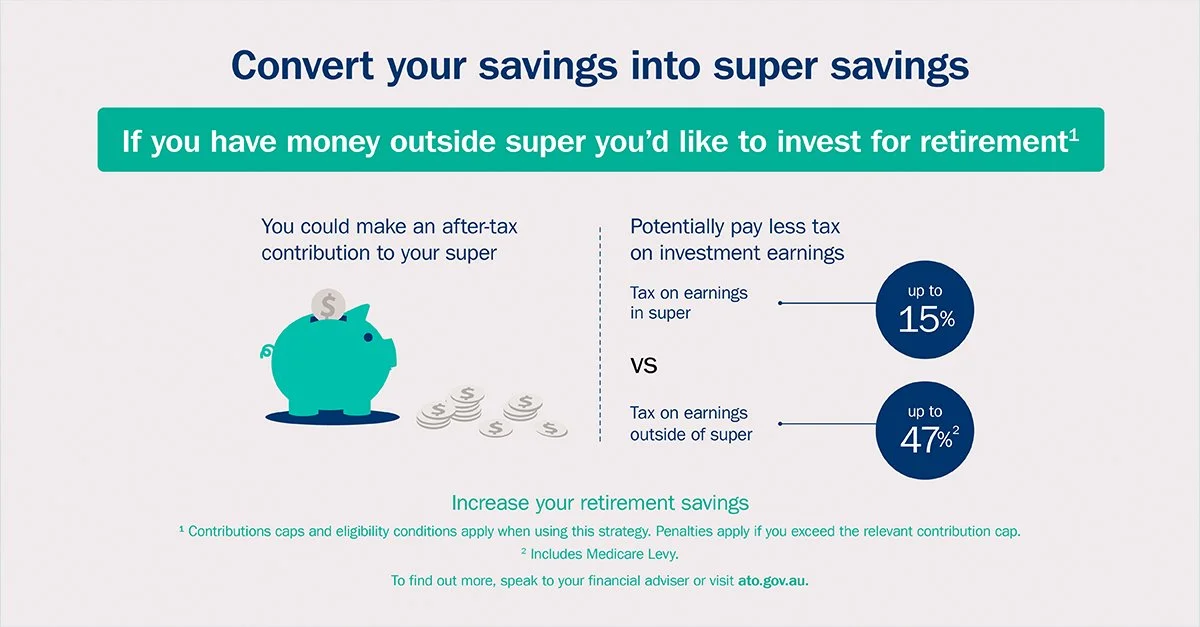

put other savings into your super

Make an after-tax super contribution by adding any other savings you may have to your super fund.

Get a super top-up from the Government

If you have an income below $58,445 per annum and make an after-tax super contribution you may be eligible to receive a Government co-contribution of up to $500.

Boost your spouse’s super and reduce your tax

If your spouse’s income is below $40,000 you can make an after-tax contribution into their super. With this strategy you may achieve a tax off-set of up to $540.

Before you add to your super, keep in mind you won’t be able to access the money until you meet certain conditions. There is a cap on how much you can contribute to super each year. It’s important to take the caps into account, as penalties may apply if you exceed them. Make sure any contributions you want to make this financial year are received by your fund before June 30. With electronic transfers, the contribution takes effect the day your super fund receives the money, not the day you make the transfer.

Everyone’s circumstances are different, and your adviser can help you come up with the best strategy to help you achieve your overall financial goals. If you are wondering if boosting your super is the right thing for you to do this year, get in touch.

General Advice Warning: The information provided in this article is general in nature and does not consider your particular investment objectives, financial situation or insurance needs; we therefore recommend you seek advice tailored to your individual circumstances before making any specific decisions.

Dobbrick Financial Services (Gympie) Pty Ltd ABN 48 931 205 109 & DFS Oakland ABN 64 340 527 395 and their advisers are authorised representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306. DFS (Ipswich) Pty Ltd ABN 86 100 184 521 and their advisers are authorised representatives of Fortnum Private Wealth LTD ABN 54139889535 AFSL 357306.