The Government recently announced its 2022-23 Budget. Like most years, the Budget announcement occupied the news cycle in the days following its release and you may recall news coverage of a range of proposed measures to help in rebuilding our economy as we continue pandemic recovery and other measures targeted at assisting with cost-of-living pressures.

If you are in any doubt about exactly what these measures mean for you, please don’t hesitate to contact us.

Finally, it is important to note that at this time these proposed measures are not yet law and could change as they make their way through the Parliamentary process.

Tax

A one-off $420 tax-break

The Government stated that it will implement a one-off $420 cost of living tax offset for low and middle-income tax offset (LMITO) recipients in the current (2021-22) financial year. When combined with LMITO, this will mean eligible low- and middle-income earners will receive up to $1,500 for a single income household, or up to $3,000 for a dual income household.

The Government estimates this will benefit over 10 million individuals. The LMITO for the 2021-22 financial year will be paid from 1 July 2022 when individuals submit their tax returns.

Temporary reduction in fuel price

There will be a temporary reduction of 50% in excise and excise-equivalent custom duty rates for all petrol and diesel for six months. The excise and excise-equivalent customs duty rate for all other fuel and petroleum-based products (excluding aviation fuels) will also be reduced by 50% for a period of six months. This will decrease excise on petrol and diesel from 44.2 cents per litre to 22.1 cents per litre. This measure will commence from 12:01 am on 30 March 2022 until 11:59 pm on 28 September 2022.

To ensure that the reduced rates are passed on to the end consumer, the Australian Competition and Consumer Commission will monitor the price behaviour of retailers.

No change to the Government’s previously announced personal income tax cuts

The Government’s legislated ‘Stage 3’ personal income tax cuts will continue as planned from 1 July 2024. These changes will mean anyone earning between $45,000 p.a. and $200,000 p.a. will pay a maximum tax rate of 30%.

Increase to Medicare Levy low-income thresholds

The 2021-22 financial year Medicare Levy low-income thresholds will be indexed for individuals and families. The threshold for singles will increase to $23,365 per annum and, for families with no children, increase to $39,402 per annum. For individuals and couples who are eligible for the Seniors and Pensioners Tax Offset (SAPTO), the thresholds will increase to $36,925 per annum and $51,401 per annum respectively. The additional threshold amount for each dependent child or student will increase to $3,619 per annum.

$250 Cost of Living Payment

The Government will make a one-off $250 Cost of Living Payment to eligible recipients to help them deal with the cost of living. The payment will be made from 28 April 2022. The payment will not be taxable and will not be counted as income for Social Security purposes.

The Cost of Living Payment will be made to people in receipt of the following on 29 March 2022:

• Age Pension

• Disability Support Pension

• Parenting Payment

• Carer Payment

• Carer Allowance (if not in receipt of a primary income support payment)

• Jobseeker Payment

• Youth Allowance

• Austudy and Abstudy Living Allowance

• Double Orphan Pension

• Special Benefit

• Farm Household Allowance

• Pensioner Concession Card holders

• Commonwealth Seniors Health Card holders

• Eligible Veterans’ Affairs payment recipients and Veteran Gold Card holders

Only one Cost of Living Payment can be received per person. The payment will only be available to Australian residents.

Lowering the Safety Net thresholds for the Pharmaceutical Benefits Scheme

The Government will reduce the Pharmaceutical Benefits Scheme (PBS) Safety Net thresholds from 1 July 2022. The thresholds will reduce from $326.40 to $244.80 for concessional patients and from $1,542.10 to $1,457.10 for general patients. These reduced thresholds are a good news story meaning eligible persons will reach the safety net sooner with approximately 12 fewer scripts for concessional patients and two fewer scripts for general patients in a calendar year. On reaching the PBS Safety Net threshold, concessional patients receive their PBS medicines at no cost for the rest of the calendar year and general patients receive their medicines at the concessional co-payment rate which is currently $6.80 per prescription.

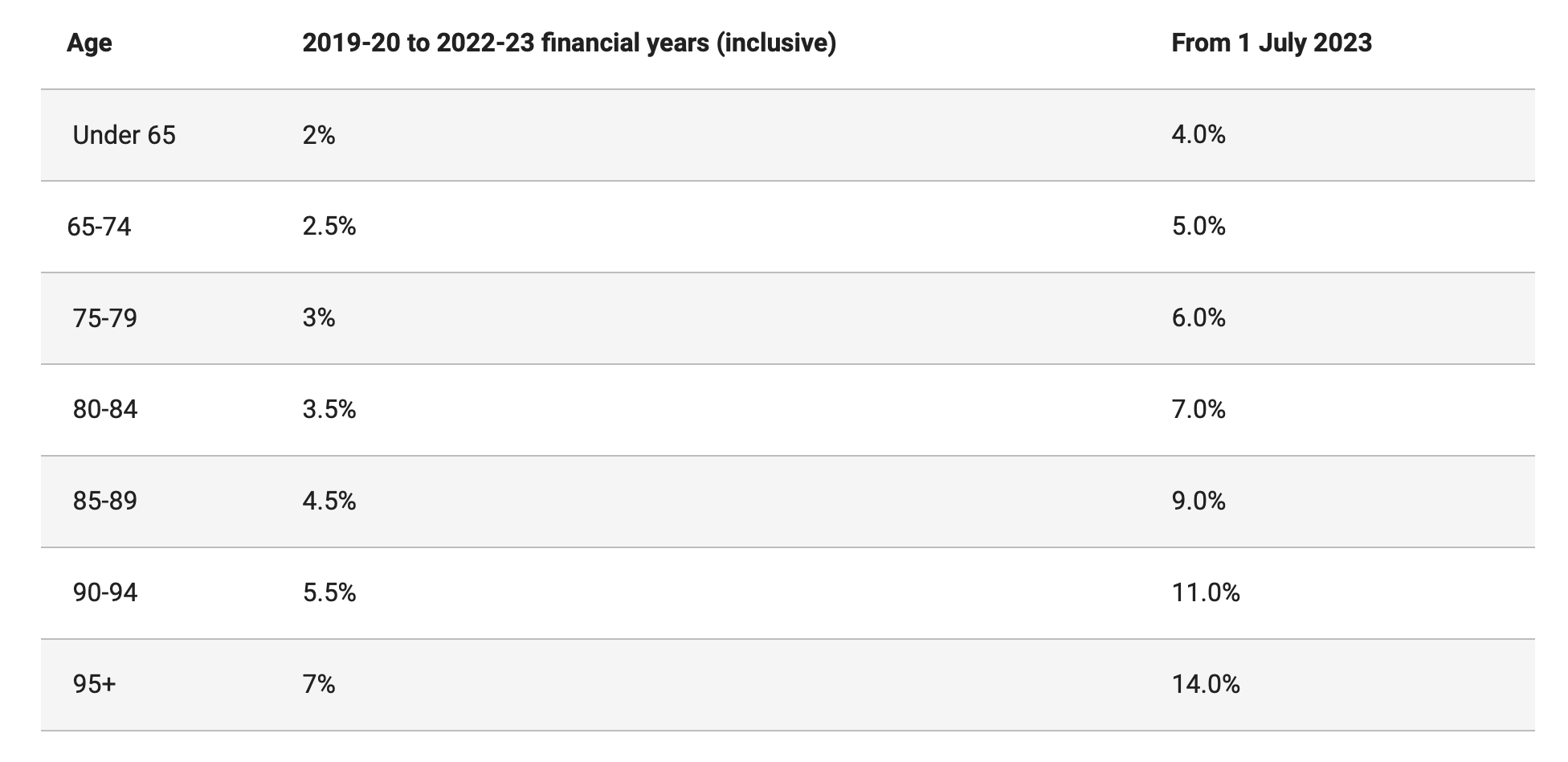

Extension of the 50 per cent reduction to the superannuation minimum payment requirements

The Government has announced the extension of the current 50% reduction to the superannuation minimum drawdown requirements for account-based income streams for a further year until 30 June 2023.

The following table summarises the reduced minimum payment requirements for account-based income streams:

These rules may allow you to draw a smaller amount from your superannuation account-based income stream if you choose. A reduced level of drawdown could help sustain your retirement savings for a longer period, but this would come at the cost of reduced income for you.

The advice you receive from your financial adviser is unique to you. Should you have any questions regarding these measures please don’t hesitate to get in touch.