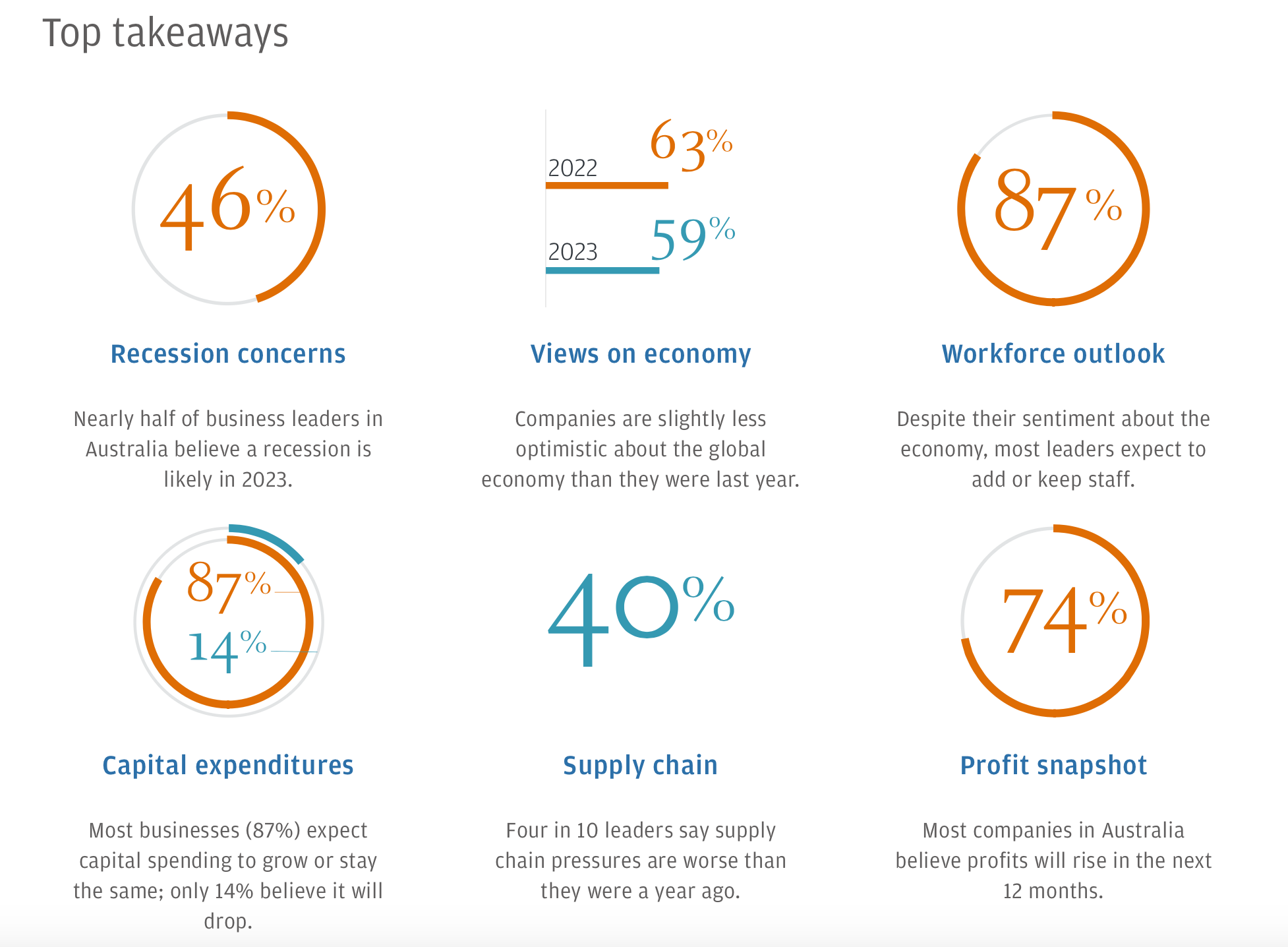

The business world is reporting a mood of cautious optimism about the economic global and national outlook for 2023, according to a recent survey released by JP Morgan. 59% of respondents are feeling positive about the future which is heartening. Yet, 46% of Australian business leaders are saying they expect a recession this year. This is significant and worth paying attention to.

Rising costs, in particular energy continue to be a burden with two-thirds of companies citing this expense as their biggest challenge. Other concerns are the increased cost of capital and supply chain issues.

Despite the inflationary challenges, most leaders are confident in their own companies. An impressive 94% expect their revenues to increase or remain the same in 2023.

Source: JP Morgan Business Leaders Outlook survey

Monetary policy during 2023 is likely to be characterised by the RBA being ready to deliver further interest rate hikes. However, this will be discouraged if inflation falls, the domestic economy slows, the global economy falters and unemployment rate rises.

As always, there is no crystal ball. These sentiments are no doubt reflected more generally across all sectors and we continue to watch the markets closely. We will advise our clients on appropriate adjustments to their investment strategies as things evolve. If you have any specific concerns about your portfolio please get in touch.

General Advice Warning: The information provided in this article is general in nature and does not consider your particular investment objectives, financial situation, or insurance needs; we therefore recommend you seek advice tailored to your individual circumstances before making any specific decisions.

Dobbrick Financial Services (Gympie) Pty Ltd ABN 48 931 205 109 and Dobbrick Financial Services (Ipswich) ABN 86 100 184 521 & DFS Oakland ABN 64 340 527 395 and their advisers are authorised representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306.