On Tuesday evening, the treasurer Jim Chalmers handed down his third Labor Budget. A Budget surplus of $9.3 billion is forecasted for 2023-24 which will be short-lived with an underlying cash deficit of $28.3 billion is expected in 2024-25 (and a $42.8 billion deficit for 2025-26). The Budget noted a weak and uncertain global economy where growth is forecast to remain subdued over the next few years.

Inflation is expected to remain elevated at 3.5% for 2023-24, which is then expected to fall to 2.75% in 2024-25.

The Government plans to spend billions to cut energy bills and rent, lowering headline inflation and providing relief for voters grumbling about cost-of-living pressures ahead of an election next year.

You can read a detailed summary here but here are some of the changes that may impact you.

Tax and Superannuation

No changes to stage 3 personal income tax cuts

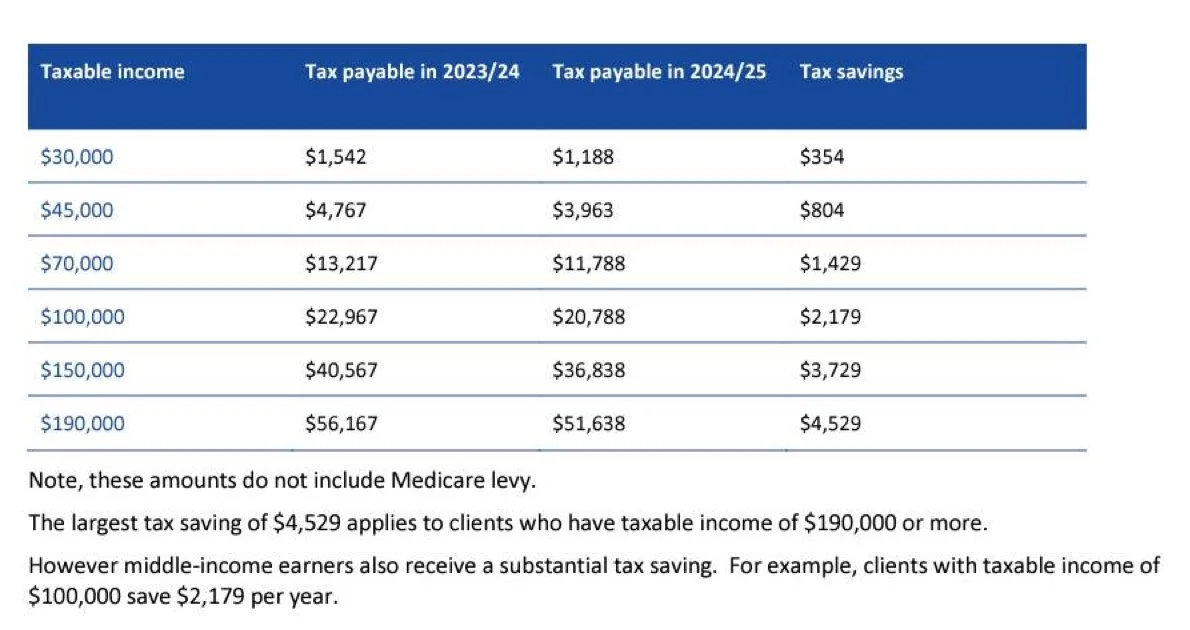

The Government made no further announcements to the legislated revised stage 3 tax cuts which will commence from 1 July 2024. The Treasurer said all 13.6 million taxpayers will receive a tax cut from 1 July 2024. The average annual tax cut is $1,888 (or $36 a week).

This table highlights tax savings that can be achieved under the new legislation .

*Source: Colonial First State

Small business instant asset write-off

The Government will improve cash flow and reduce compliance costs for small businesses by extending the current instant asset write-off concession for another 12 months.

Small businesses, with aggregated annual turnover of less than $10 million, will be able to immediately deduct the full cost of eligible assets costing less than $20,000 that are first used or installed ready for use between 1 July 2023 and 30 June 2024. The $20,000 threshold will apply on a per asset basis, so small businesses can instantly write off multiple assets.

Paying superannuation on Government funded Paid Parental Leave Payment (PPL)

The Government will provide $1.1 billion over four years from 2024-25 (and $0.6 billion per year ongoing) to strengthen Australia’s government-funded PPL for births and adoptions on or after 1 July 2025. Eligible parents will receive an additional payment based on the Superannuation Guarantee (12%) of their PPL payments), as a contribution to their superannuation fund. Both partners are entitled to superannuation on their PPL payment.

This measure will help normalise parental leave as a workplace entitlement, like annual and sick leave, and reduce the impact of parental leave on retirement incomes.

Housing

Making it easier to buy a home

The Government is giving more money to build homes for Australians faster, improve housing infrastructure, train more construction workers, and support affordable housing and homelessness services.

Cost of living and government assistance

Energy bill relief fund for all households and eligible small businesses

The Government will provide $3.5 billion over 3 years from 2023-24 to extend and expand the Energy Bill Relief Fund to provide a $300 rebate to all Australian households and a $325 rebate to eligible small businesses on their 2024-25 electricity bills.

Pharmaceutical Benefits Scheme (PBS) changes

Pharmaceutical Benefits Scheme changes: The Government is working to finalise the new Eighth Community Pharmacy Agreement, supported by up to an additional $3 billion in funding. As part of the Agreement, instead of rising with inflation, there will be a one-year freeze on the maximum PBS patient co-payment for everyone with a Medicare card and a five-year freeze for pensioners and other concession cardholders.

Social Security deeming rates freeze for a further 12 months

The Government announced that it will extend the freezing of the social security deeming rates at their current rate for a further 12 months until 30 June 2025 to help with cost-of-living pressures.

Strengthening Medicare and the care economy

The Government is investing $2.8 billion to continue its commitment to strengthen Medicare.

Increase to rent assistance

The Government will provide $1.9 billion over five years from 2023-24 (and $0.5 billion per year ongoing from 2028-29) to increase all Commonwealth Rent Assistance maximum rates by 10% from 20 September 2024 to help address rental affordability challenges for recipients. This builds on the 15% increase in September 2023 and will take maximum rates over 40% higher than in May 2022.

Carer Payment improve flexibility

From 20 March 2025, the Government will make amendments to the eligibility criteria for Carer Payment recipients, the existing 25 hour per week participation limit will be amended to 100 hours over four weeks.

It is important to note the Budget announcements are still only proposed at this stage and to be legislated. Changes can also be made prior to these proposals becoming law.