Are you wondering if you are on track with your super savings? Perhaps you haven’t given it much thought. It’s easy, when you are young to think retirement is so far away that it’s not something you need to worry about right now. But the sooner you start to focus on super, the better. Starting early, being consistent and investing well, will put you in good stead for the future. A healthy superannuation balance will ensure you can have the lifestyle you want when you do decide to stop working. It may even assist you to retire earlier if you want.

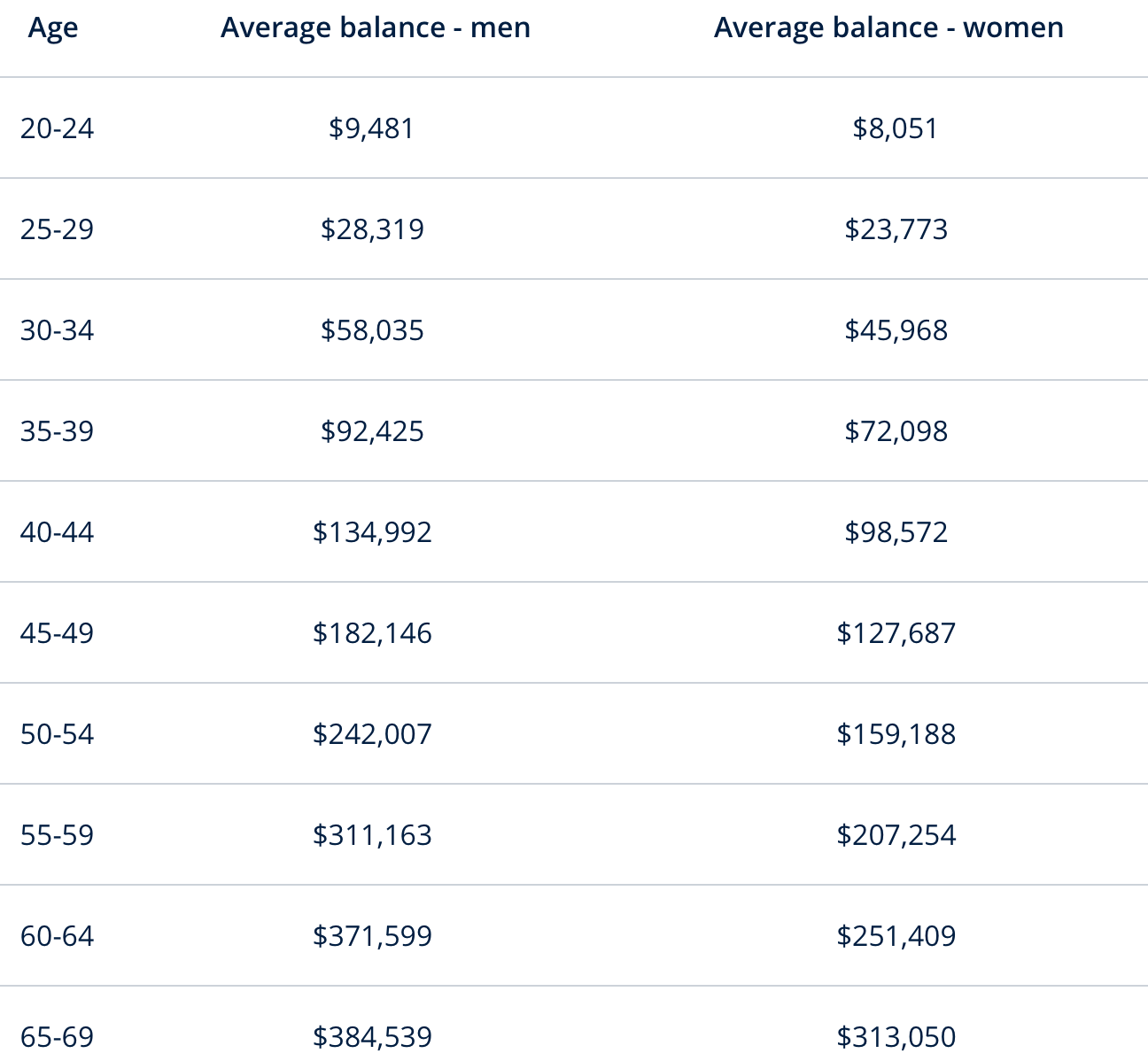

If you are curious about how your balance stacks up compared to other people your age, The Association of Superannuation Funds Australia (ASFA) provides the following guideline. 1

If your balance looks low compared to the average for your age group there may be reasons for this. If you have taken time out of work to study, travel, or care for older relatives there may have been a gap in your contributions. Other factors will affect your balance such as unemployment, working part-time or earning a lower wage than others of your age. As you can see women are more likely to have less super than males. Often this is due to taking time off to raise children.

How to increase your super balance

There are some simple things you can do to accelerate your super savings if you know the rules and what they are. It is always wise to seek professional advice before you do so, but you may be interested to know there are some relatively simple strategies that can make a difference.

Consolidate your super

If you have moved jobs quite a lot, its common to have several super accounts. You could be doubling up on fees and insurance premiums which are unnecessary expenses that can impact your balance. Talk to your adviser about the best super fund for you. Make sure it’s in alignment with your tolerance for risk and that the fees are reasonable.

Salary sacrifice and tax-deductible super contributions

‘Salary sacrificing’ is a strategy by which you can ask your employer to put part of your pay cheque into super. If your employer doesn’t provide this service, then you can do it yourself. The great thing about this is that any contributions are also a great way to minimise tax.

Contributing part of future pay rises to super

If you feel salary sacrificing is out of your budget for the moment consider directing a proportion of your future pay increases into your super. If you increase your contributions as your income increases it will be less painful. You can still enjoy some of the pay rise whilst knowing you are also contributing to your future.

This handy calculator may also help to give you an idea of where you should be at but be aware that it may not have taken into account ebbs and flows in your employment due to your particular circumstances. Don’t be too hard on yourself if you are not quite there. One of the most common questions our clients ask is ‘how much do I need to retire?’ It’s never too late to implement strategies to improve your situation. Talk to us about how we can help.

We have an experienced team of financial planners on the Sunshine Coast, Gympie, Brisbane and Ipswich.

[1] ASFA Experience to date with early release of super

General Advice Warning: The information provided in this article is general in nature and does not consider your particular investment objectives, financial situation, or insurance needs; we therefore recommend you seek advice tailored to your individual circumstances before making any specific decisions.

Dobbrick Financial Services (Gympie) Pty Ltd ABN 48 931 205 109 and Dobbrick Financial Services (Ipswich) ABN 86 100 184 521 & DFS Oakland ABN 64 340 527 395 and their advisers are authorised representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306.