Our advisers, Paul Dobbrick (Gympie), Megan Neale (Ipswich), Ryan Dobbrick (Ipswich), David Southwood (Ipswich)

The ongoing trade war and geopolitical shake up due to changes in alliances is creating uncertainty among investors around the world. We asked our financial planners to share some wisdom on how they approach investing in times like these.

Global politics are volatile now, what impact is this having on the investment landscape?

Trump is threatening to impose tariffs on various products in numerous countries, and investors are worried about the impact as this plays out. This concern creates a sense of uncertainty and triggers knee-jerk actions which pushes markets downwards.

Markets love knowing what to expect and Trump is proving that the current norm seems to be, expect the unexpected. It is difficult to determine what is coming around the corner but Trump prides himself on the performance of the share market, so it is not in his interests to see a continuation of this volatility. We hope that things will settle down in the coming months.

As financial planners, what is your philosophy in turbulent times?

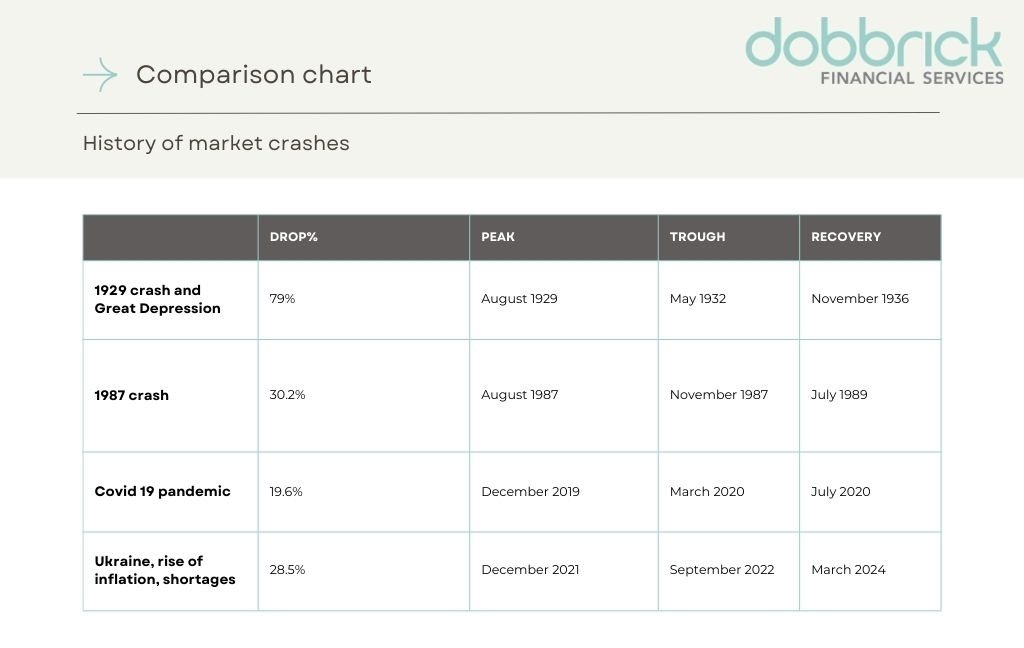

This sort of stuff doesn’t go on forever – sit tight – don’t make rash decisions. We have seen market crashes many times over the years. The GFC, September 11, Covid19 and many other world events have triggered volatility. In times like these we recommend sitting tight. It won’t be like this forever.

Our approach to investing is conservative anyway so we have entered this crisis in a protective position, with overweight exposure to bond markets and alternatives like gold.

Our clients are all invested according to their unique tolerance for risk and will be experiencing downs as part of a diversified portfolio.

What not to do with your money in this environment?

Do not do anything until you talk to us first. Hasty selling of growth style assets is fraught with danger. Let us make the important asset allocations behind the scenes.

Whilst it may feel tempting to follow the sentiment of the crowd, be careful you don’t turn paper losses into real losses. Experience has shown us that those who have taken this path before experience a double whammy. First comes the physical loss. Then you wait for the market to show strong signs of recovery before ‘getting back in.’ This means you miss out on recovery time and must start again.

What can you control in this environment?

You can control you – how you react and what you do. Again, working with us during these times will help you make sound, informed decisions to ensure you keep on track, even if things are a bit scary now.

80% of risk is determined by the types of assets you are invested in. We are keeping a close eye on things and our door is always open if you have any concerns.

Are there any silver linings?

If prices drop significantly there may be a buying opportunity but again, talk to us first.

Over time the Trump effect, and tariff talk will settle, just as it has before. Give it time. If you go back in history markets always bounce back. Given time the norm will return, recovery will happen, and we can all sleep better.

General Advice Warning: The information provided in this article is general in nature and does not consider your particular investment objectives, financial situation, or insurance needs; we therefore recommend you seek advice tailored to your individual circumstances before making any specific decisions.

Dobbrick Financial Services (Gympie) Pty Ltd ABN 48 931 205 109 and Dobbrick Financial Services (Ipswich) ABN 86 100 184 521 & DFS Oakland ABN 64 340 527 395 and their advisers are authorised representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306.