Some significant superannuation boosting opportunities have become available because of recent legislation changes. These new Laws are particularly good news for older Australians who stand to benefit the most. If you are assuming the super door has been closed forever, think again. Now is a great time to seek advice on how to minimise tax and maximise your retirement savings. There is also some good news for retirees looking to downsize and those saving for their first home.

The legislated changes include:

Removal of the work-test requirement for non-concessional contributions (NCCs) and salary sacrifice contributions, for individuals aged between 67 and 75

If you are in this age bracket you will be able to make or receive non-concessional superannuation contributions (after tax contributions) or salary sacrificed contributions without meeting the work test, subject to existing contribution caps. You will also be able to access the non-concessional bring forward arrangement, subject to meeting the relevant eligibility criteria.

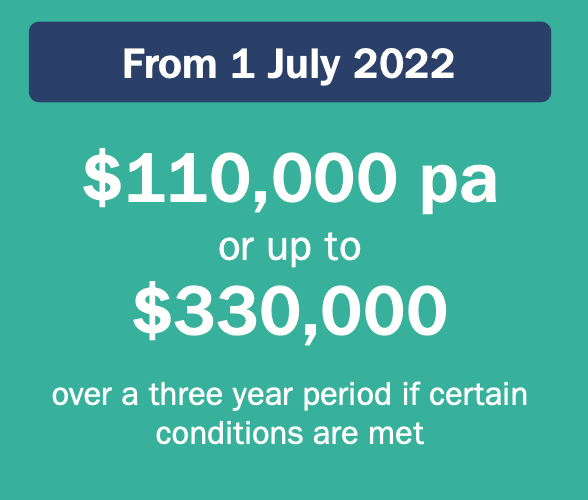

For example, you may be 70 years old and not worked or contributed to superannuation for many years. You sell an investment property in August 2022 for $450,000. Under the old rules, you were ineligible to contribute to superannuation. You are now able to contribute up to $110,000 into superannuation for a single financial year however can also access the bring forward rule which allows contributions of up to $330,00 in a financial year.

Extended eligibility to make NCCs under the bring-forward rule to individuals aged under 75 at the beginning of the financial year

From 1 July 2022, the age limit increased to age 75, allowing people in their early 70s to start a bring-forward arrangement. If you’re under age 75 at any time in a financial year you may now be eligible to contribute of up to three times the annual general non-concessional cap in that financial year.

Extended eligibility to make downsizer contributions to those aged 60 or over

Previously, contributions from home sale proceeds to super could only be made by Australians aged 65 or older. This age has been lowered from 65 to 60 from 1 July 2022.

This means individuals in this age group now have more flexibility in organising their financial affairs on selling their home, with the ability to contribute up to $300,000 of the sale proceeds into superannuation. This is in addition to the normal superannuation contribution caps. This means if a couple were to sell their home, up to $600,000 could be contributed to a tax effective environment for future retirement needs.

If you are thinking of downsizing, now could be a good time.

An increase to the maximum number of voluntary contributions made to super that can be released under the First Home Super Saver Scheme (FHSSS).

The amount of eligible contributions for Australians that can count towards maximum releasable amount for FHSS scheme has increased from $30,000 to $50,000. The eligible contributions that can count towards FHSS each financial year will remain at $15,000.

This small change to the First Home Super Saver Scheme will further assist first-home buyers in using Australia’s superannuation system as a tax-effective way to save for part of their home deposit.

It makes sense to tap into these new rules. As always, the sooner you do the better so that you can benefit from compounding interest and increase your retirement nest egg. If you would like more advice on how to best leverage the new super rules please get in touch.

General Advice Warning: The information provided in this article is general in nature and does not consider your particular investment objectives, financial situation, or insurance needs; we therefore recommend you seek advice tailored to your individual circumstances before making any specific decisions.

Dobbrick Financial Services (Gympie) Pty Ltd ABN 48 931 205 109 and Dobbrick Financial Services (Ipswich) ABN 86 100 184 521 & DFS Oakland ABN 64 340 527 395 and their advisers are authorised representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306.